The $5 Billion Fortress That Didn’t Work

What the Maginot Line Teaches Us About Money

When it rains, it pours. That’s when you buy the umbrella, so you're ready next time. Right?

That’s how most of us approach risk. Especially after we’ve been burned.

In 1918, World War I ended. The world exhaled. Countries turned inward, battered and broken. France, in particular, had suffered devastating losses: 4.5% of its population was killed in the war. That’s the modern equivalent of the entire city of Paris being wiped out. Millions more were wounded or disfigured, and many French cities were reduced to rubble, mostly due to Germany’s invasion.

France’s response?

A promise: Never again.

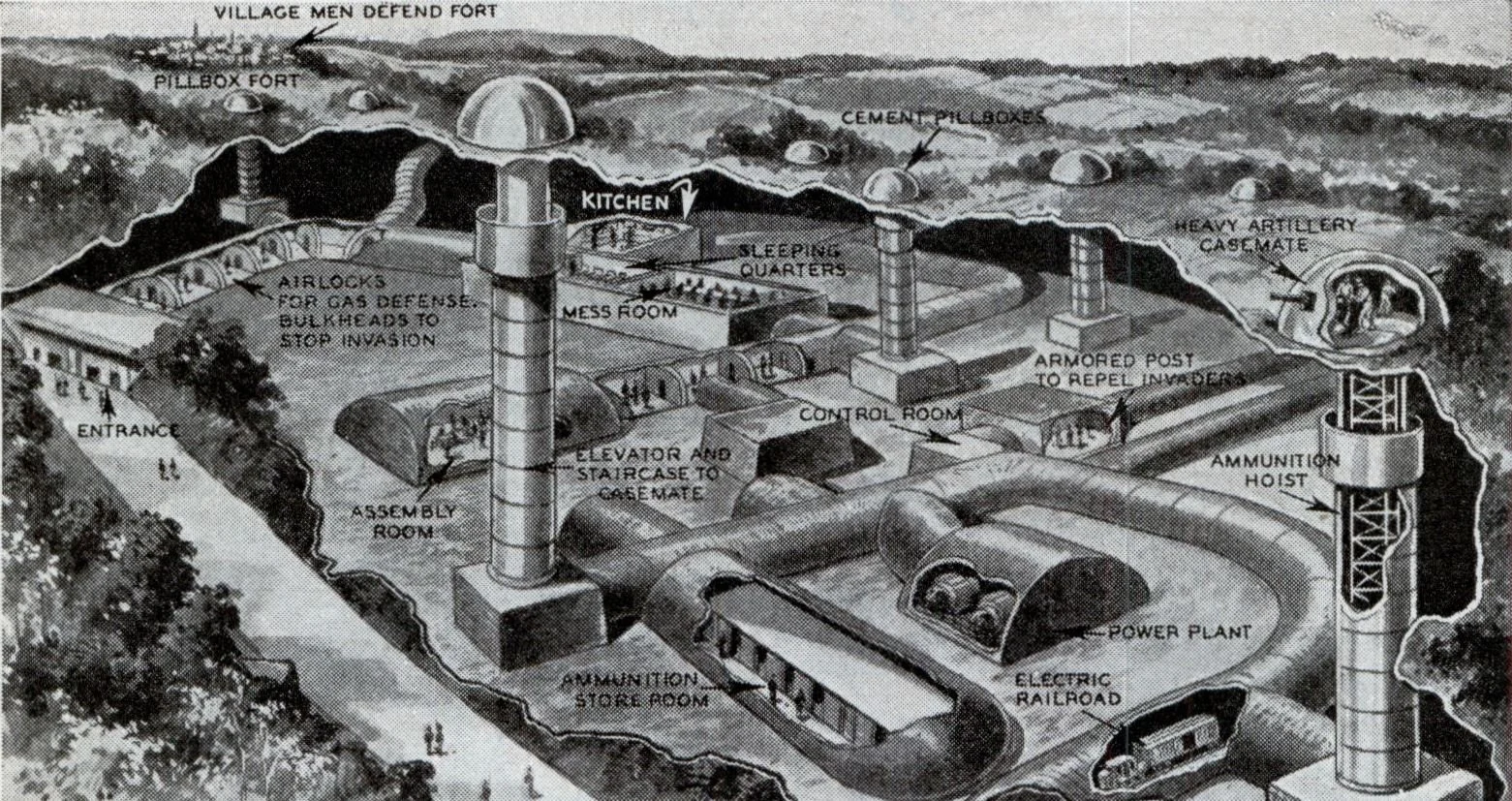

That severe, national pain birthed one of the most expensive and ambitious defense projects in history: The Maginot Line, a concrete fortress stretching hundreds of miles along the German border, preventing a direct invasion from the Germans on French soil. This consisted of underground bunkers, train lines, air-filtration systems, and turrets that popped up from the ground.

Underground depiction of one section of the Maginot Line

This barricade cost the equivalent of $5 billion in today’s dollars.

Despite its strength and engineering precision, the Maginot Line was flawed.

It covered only the most direct route from Germany into France. The French believed the Ardennes Forest to the north (bordering Belgium) was impenetrable.

They were wrong.

In May 1940, less than a decade after the Maginot Line’s construction began, Hitler launched a Blitzkrieg. German forces bypassed the Maginot Line entirely, moving through Belgium and the Ardennes, intentionally picking a path the French thought was “impossible”.

France fell six weeks later.

And the Maginot Line?

Never engaged in battle.

It remained fully intact…and completely irrelevant.

The Maginot Line bunkers, never used in combat.

The irony is brutal:

France built a fortress for the last war.

Germany built a strategy for the next one.

And We Do the Same Thing With Money

We build financial fortresses based on past trauma:

“I lost a fortune in tech stocks in ’01. Never again.”

“After getting crushed in ’08, I’m in cash forever now.”

I’ve heard these and others far too often.

But the next crisis rarely announces itself in the same manner as before.

We end up protecting ourselves from the acute pain we don’t ever want to feel again, while leaving ourselves exposed to future threats: inflation, longevity, underperformance, missed opportunities.

As Morgan Housel puts it:

“Your personal experiences make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.”

The Maginot Line wasn’t a failure of strength.

It was a failure of imagination.

So are most financial plans.

Resilience doesn’t come from immovable concrete.

It comes from flexibility, options, and the ability to adapt.

This is why I created The Flex Factor, a newsletter focused on financial resilience, not rigid formulas.

If you want your plan to survive the next crisis, not just the last one, click here to join.